Early Voting Early Results

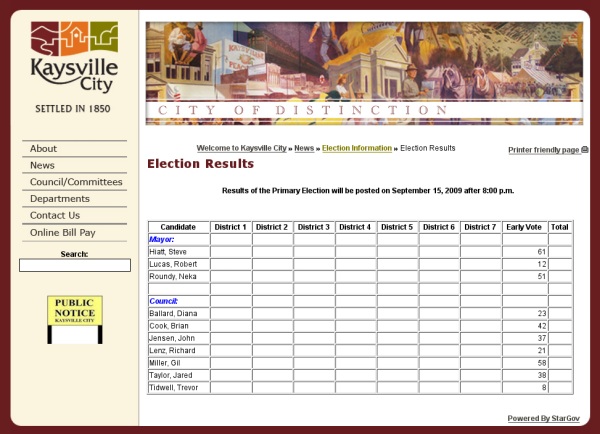

The results of the early voting shows that Steve Hiatt, with 61 votes, has taken an early lead over Mayor Neka Roundy who has garnered 51 votes.

In the City Council race Gil Miller’s 58 votes lead, followed by Brian Cook sporting 42 votes. Jared Taylor (38 votes) and John Jensen (37 votes) are very close behind. Here is a full screenshot of the results.

Early Posting

Who would have thought that early votes could be posted on the city website before the day of the election? Other voters may be swayed by seeing who has an early lead. Maybe that’s why they are called early votes — because you get to see them early.

Updates

15 Sep 2009 — A check at 9:30am this morning (election day) showed that the early voting tallies had been removed.

16 Sep 2009 — Unofficial results: Steve Hiatt (1,570) and Neka F. Roundy (910) move on to the General Election. Gil A. Miller (1,427), Brian D. Cook (1,035), Jared R. Taylor (889), and Richard Lenz (801) also qualified for the General Election.

It is interesting to note that of the six winners, the top five followed the same order as the early voting results. Remarkable.