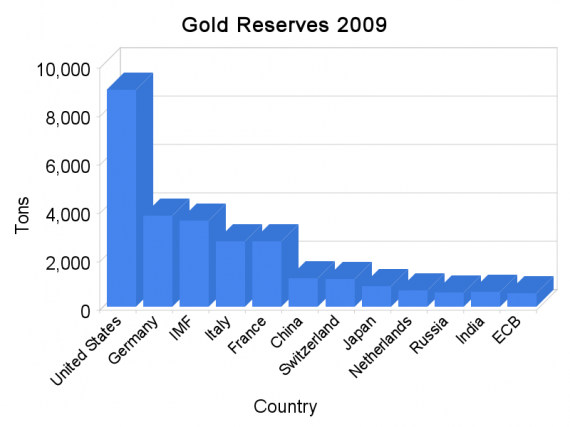

With China and India acquiring gold it is interesting to see that the United States still holds almost eight times the gold that China does and more than fourteen times India’s reserves.

Of note is that the United States has 78% of its foreign reserves in gold. Of the countries listed below only Greece (91.6%), Portugal (90.3%), and the Slovak Republic (83.3) have higher rates. However, China has only 1.8% of its foreign reserves in gold. India is looking a little better at 6%.

Only the top 50 countries by gold reserves are listed below. Of course the IMF and a few others are not countries but they do own substantial holdings.

Click on the column headers to sort.

| Country | Tons1 | Percent2 | $ Billion3 |

|---|---|---|---|

| United States | 8,966 | 78.3 | 313.80 |

| Germany | 3,762 | 69.5 | 131.66 |

| IMF | 3,546 | N/A | 124.13 |

| Italy | 2,703 | 66.1 | 94.59 |

| France | 2,701 | 73.0 | 94.55 |

| China | 1,162 | 1.8 | 40.66 |

| Switzerland | 1,147 | 37.1 | 40.13 |

| Japan | 843 | 2.1 | 29.52 |

| Netherlands | 675 | 61.4 | 23.63 |

| Russia | 592 | 4.0 | 20.71 |

| India | 615 | 6.0 | 21.52 |

| ECB | 553 | 18.3 | 19.34 |

| Taiwan | 467 | 3.8 | 16.34 |

| Portugal | 422 | 90.3 | 14.76 |

| Venezuela | 393 | 36.5 | 13.75 |

| United Kingdom | 342 | 17.9 | 11.97 |

| Lebanon | 316 | 26.8 | 11.07 |

| Spain | 310 | 39.0 | 10.86 |

| Austria | 309 | 56.3 | 10.80 |

| Belgium | 251 | 40.4 | 8.78 |

| Algeria | 191 | 3.4 | 6.70 |

| Philippines | 170 | 11.2 | 5.94 |

| Libya | 159 | 4.3 | 5.55 |

| Saudi Arabia | 158 | 11.9 | 5.52 |

| Sweden | 146 | 13.5 | 5.10 |

| Singapore | 140 | 2.1 | 4.92 |

| South Africa | 137 | 10.4 | 4.81 |

| BIS | 132 | N/A | 4.63 |

| Turkey | 128 | 4.9 | 4.48 |

| Greece | 124 | 91.6 | 4.34 |

| Romania | 114 | 8.1 | 4.00 |

| Poland | 114 | 4.8 | 3.97 |

| Thailand | 93 | 2.0 | 3.24 |

| Australia | 88 | 7.0 | 3.08 |

| Kuwait | 87 | 18.6 | 3.05 |

| Egypt | 83 | 6.3 | 2.92 |

| Indonesia | 81 | 3.8 | 2.82 |

| Kazakhstan | 80 | 10.6 | 2.80 |

| Denmark | 73 | 4.0 | 2.57 |

| Pakistan | 72 | 17.5 | 2.52 |

| Argentina | 60 | 3.4 | 2.11 |

| Finland | 54 | 17.7 | 1.89 |

| Bulgaria | 44 | 7.2 | 1.54 |

| WAEMU | 40 | 10.6 | 1.41 |

| Malaysia | 40 | 1.2 | 1.40 |

| Peru | 38 | 3.2 | 1.34 |

| Brazil | 37 | 0.5 | 1.30 |

| Slovak Republic | 35 | 83.3 | 1.23 |

| Bolivia | 31 | 10.4 | 1.09 |

| Ukraine | 29 | 3.1 | 1.03 |

Not all countries are listed.

Notes

1. 1 tonne = 1.10231131 short tons.

2. Percentage share in gold of total foreign reserves.

3. 1 short ton = 29,167 troy ounces. Worth is calculated at $1,200 per troy ounce.

Sources

“International Financial Statistics,” International Monetary Fund, 2009.

“Gold reserve“, Wikipedia.

This is exactly why you should invest in precious metals like gold and silver. Sure, the US still leads the world in gold reserves. But anytime, countries like China could use their US trillions in bonds to buy gold anywhere in the world. You what’s going to happen? The US dollar can drop 50% or more overnight.

For those of us who cannot afford gold what do you think of silver?

Thanks for the reply and for the question. I actually believe that silver is a better investment than gold. I wrote an article about it in my newsletter. You can check out my site for the article but do let me know if you want the direct link. I don’t want to post links in my comment out of respect for you. There’s a gold/silver price chart for the past 10 years to see the relative performance of silver vs. gold. Silver has actually been outperforming gold for the last 19 years.

The historic price ratio of silver to gold will tell us that 10 ounces of silver can buy 1 ounce of gold. As of today, the ratio is about 64 ounces of silver to 1 ounce of gold. Once it returns to its historic value or even get close to it, you will actually make more money investing in silver than in gold. I also have the numbers to show how silver will exceed the historic price ratio.

Thanks for the reply. My blog is giving me some homepage difficulties (I deleted some files I should’nt have) but the comments are working OK. It’s OK to post the direct link, others may want to see it as well as me. I will take another look at your site as soon as I get my blog fixed.

I have read about the gold/silver ratio and it seems that silver is a better buy. Do you have a forecast for silver? Do you think it will ever drop to under $10 or I am dreaming?

Hi there. Here are the links:

Why Silver will be a better investment than Gold:

http://silverstockreport.com/2009/silver-better.html

Introduction to Silver:

http://silverstockreport.com/introduction.html

Everything you need to know is there. You can also browse through my other articles. Feel free to call for any questions or you can send me an email. I’ll be happy to help.

Thank you for the links, I followed them and read the articles. Very informative. One point, does photography still use 20% of world production of silver? Digital cameras are so good nowadays that I would think that percentage would be lower. Maybe it is old data?

Gold and silver will always be of value, even more so when our paper currency is worthless. The Fed steals wealth through inflation, but it is tough to steal ones wealth overtly when it is precious metals.

Sure, the US still leads the world in gold reserves. But anytime, countries like China could use their US trillions in bonds to buy gold anywhere in the world. You what’s going to happen? The US dollar can drop 50% or more overnight.

China is unlikely to dump trillions in dollars all at once. First they would need buyers and secondly they would receive diminishing returns as the sale progressed. Third, their own currency would appreciate, thus rendering their exports very expensive.

Although I do not like the U.S. being such a debtor nation when it is so unnecessary, her position is not as grave as it appears. That said, the sooner politicians are elected that will balance the budget, the better. Fortunately there is currently a great awareness of this so that in the November elections maybe we will finally get Change You Can Believe In.

I wrote an article about it in my newsletter. You can check out my site for the article but do let me know if you want the direct link. I don’t want to post links in my comment out of respect for you. There’s a gold/silver price chart for the past 10 years to see the relative performance of silver vs. gold. Silver has actually been outperforming gold for the last 19 years.

You can put direct links in your comments. I don’t mind. More than one will cause the comment to be put on hold. See the comments policy: http://www.rickety.us/site/comments-policy/

I may be conservative in my politics but I am liberal with my comments.

Hey,

thats an interesting article! I’m from Germany myself but I didn’t know that Germanys gold reserves are the second highest. But when I think about it, it’s not that a big surprise for Germans traditionally like to invest in gold. Anyway, thanks for the post

Greetings

Konstantin

I am always surprised when I collect data for a post at who owns what. The numbers are always interesting. Thanks for commenting, have a great week.

Rick