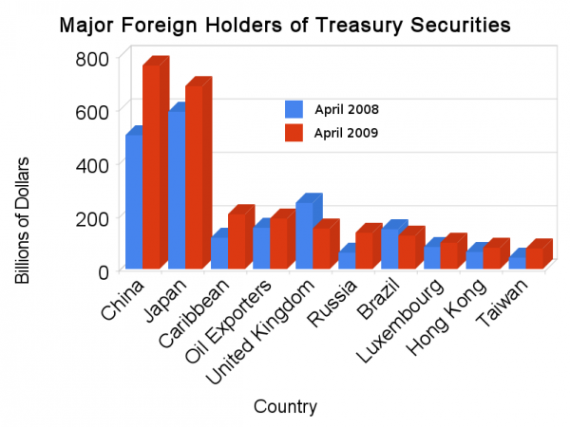

China Buying Fewer Securities?

I have read in the news several times this year that China [is] Losing [its] Taste for Debt From [the] U.S. If that was true last year it appears that China has changed its mind. Chinese holdings of U.S. debt have risen in 12 of the last 14 months for an increase of 52% (see table below). Of the ten nations in the chart above, eight have also increased their share of the U.S. debt since April 2008. Of the 32 nations and “all others” tallied in the table below, their purchases of U.S. debt has risen a collective 26% in a year.

What Does It All Mean?

Contrary to what you may have been hearing about China pulling their money out of the U.S.A., it appears the opposite is taking place. Also, a large majority of other nations are also parking their spare cash in the United States. For example, of the 32 nations in the table below, 24 have increased their debt holdings in the U.S. over the last year. This would seem to indicate that a large majority of the world view the U.S. as a safe haven. With political stability here (even with Democrats in power) and an economy nearly four times larger than the next largest economies combined, I can see why. Here are the numbers. The GDP of the United States ($14,264,600,000,000) is almost as great as the next four largest economies combined, which are those of Japan ($4,923,761,000,000), China ($4,401,614,000,000), Germany ($3,667,513,000,000), and France ($2,865,737,000,000). Furthermore, though I don’t like to admit it, there is plenty of room for increased taxes and even more scope to reduce spending, which I am happy to admit.

Even with a scenario that is not quite as bad as the news would have us believe, the U.S. still needs to work vigorously at reducing its debt. The supposed agent of change, Barack Obama, is carrying on the same old policy of borrow and spend, except in much larger quantities. How sad.

Table of Major Foreign Holders of Treasury Securities

Click on the column headers to sort.

| TOTAL | 2586.4 | 3262.9 | 26% |

| Country | Apr 2008 | Apr 2009 | Change |

|---|---|---|---|

| China | 502.0 | 763.5 | 52% |

| Japan | 588.8 | 685.9 | 16% |

| Caribbean | 117.4 | 204.7 | 74% |

| Oil Exporters | 153.8 | 189.5 | 23% |

| United Kingdom | 246.8 | 152.8 | -38% |

| Russia | 60.2 | 137.0 | 128% |

| Brazil | 149.5 | 126.0 | -16% |

| Luxembourg | 81.8 | 97.5 | 19% |

| Hong Kong | 63.1 | 80.9 | 28% |

| Taiwan | 42.2 | 78.3 | 86% |

| Switzerland | 42.4 | 64.2 | 51% |

| Germany | 43.6 | 54.6 | 25% |

| Ireland | 18.3 | 49.7 | 172% |

| Singapore | 33.5 | 39.7 | 19% |

| India | 10.5 | 38.5 | 267% |

| Korea | 40.4 | 35.4 | -12% |

| Mexico | 37.3 | 35.4 | -5% |

| France | — | 30.6 | — |

| Thailand | 27.9 | 28.5 | 2% |

| Norway | 45.3 | 27.5 | -39% |

| Turkey | 31.1 | 27.2 | -13% |

| Israel | 6.2 | 19.1 | 208% |

| Egypt | 12.7 | 18.5 | 46% |

| Netherlands | 15.5 | 16.5 | 6% |

| Italy | 10.3 | 16.2 | 57% |

| Belgium | 12.5 | 15.8 | 26% |

| Chile | 10.2 | 15.1 | 48% |

| Canada | 25.8 | 13.1 | -49% |

| Sweden | 13.1 | 12.7 | -3% |

| Philippines | 9.9 | 12.0 | 21% |

| Malaysia | 8.7 | 11.6 | 33% |

| Colombia | 6.5 | 11.4 | 75% |

| All Other | 119.1 | 153.5 | 29% |

.

Sources

Chart and table debt figures are from the Department of the Treasury and the Federal Reserve Board and is current as of June 15, 2009. The United Kingdom includes Channel Islands and Isle of Man. Oil exporters include Ecuador, Venezuela, Indonesia, Bahrain, Iran, Iraq, Kuwait, Oman, Qatar, Saudi Arabia, the United Arab Emirates, Algeria, Gabon, Libya, and Nigeria. Caribbean is the Caribbean Banking Centers including Bahamas, Bermuda, Cayman Islands, Netherlands Antilles and Panama. GDP figures are from the List of countries by GDP (nominal).

It makes sense for the United States to slowly start paying off the debt year to year.

There is also a significant portion of the debt that isn’t held foreignly. They also are earning from their investments. I guess it is sort of taxing the poor and middle-class to pay off our debts to the rich.