The following was adapted from the Improvement Era magazines of April 1911 and May 1911.

The following was adapted from the Improvement Era magazines of April 1911 and May 1911.

Inheritance Tax

The largest inheritance tax on record in the United States was lately received by the state of Utah. The check, dated March 1, 1911, was received by State Treasurer David Mattson, on the 9th of March, from Mrs. Mary W. Harriman, executrix, and was made out for the amount of $798,546.85, being the inheritance tax on the late Edward H. Harriman’s property in Utah.

The legislature on the 10th passed a bill appropriating $750,000 of the amount towards the building of the state capitol, in Salt Lake City, which had been arranged for earlier in the session, and for which a bond issue of one million dollars had been authorized.

[The story also appeared in The New York Times. The inheritance tax was 5% on $15,980,937 of Union Pacific stock. The Union Pacific Railroad was incorporated under the laws of Utah, hence payment to the state. In 2011 the Federal estate tax was 35% with Utah no longer having an inheritance tax nor an estate tax.]

Corporation Tax

The corporation tax provision in the Payne-Aldrich tariff act was held by unanimous opinion of the United States Supreme Court, rendered March 13, to be valid. The decision was announced by Justice William R. Day, appointed to the Supreme Court from Ohio, in 1903.

The opinon was an elaborate treatment of the subject, and the tax was declared to be an excise tax on the doing of corporate business, and not a direct tax on the ownership of property. It was held that the tax was not applicable to the real estate “trust” of Boston, and the Minneapolis syndicate, since they were not “doing business” within the meaning of the law.

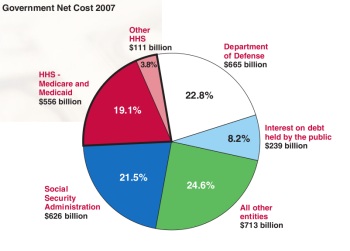

An income of approximately twenty-five million dollars annually will be assured to the government by this decision.

[In 2011, Federal tax rates on corporate taxable income varied from 15% to 35%. In 2010, 6.6% ($138.2 billion) of Federal revenue came from corporations.]

Income Tax

The national income tax amendment to the national constitution, submitted by resolution of Congress in July, 1909, has been acted on favorably this year by nineteen legislatures, eleven states have thus far rejected it. Since the amendment must be approved by three-fourths of the states, nine more states are necessary for favorable action.

Since the constitution fixes no time limit to legislative action, the legislatures which rejected it this year may approve it next. Utah so far has not joined in favor of the proposed measure.

[On February 25, 1913, the amendment was ratified by the necessary three-fourths of the states, and became a part of the Constitution. On October 3, the Revenue Act of 1913 was enacted which re-imposed the Federal income tax. The Connecticut, Rhode Island, and Utah legislatures rejected the amendment. Florida, Pennsylvania, and Virginia never considered the amendment.]

Adapted from: “Passing Events”, Improvement Era, Vol. XIV. April, 1911. No. 6 and “Passing Events”, May, 1911. No. 7